By Robert Wright in London

“Shunning harmful industries is good. Tackling poverty and injustice is even better”

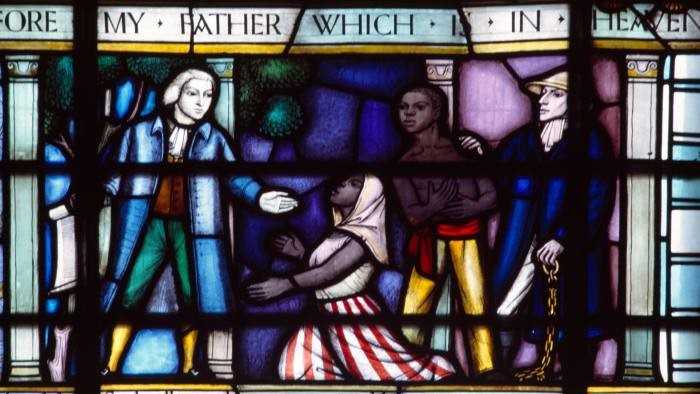

When the managers of the Church of England’s financial endowment announced plans to set aside funds to right “past wrongs” in January, the news drew attention to a growing but still niche form of investing. Of the £100mn earmarked by the Church Commissioners as restitution for the church’s role in slavery, some would go into impact investment funds — vehicles whose purpose is to achieve social impact, rather than to maximize financial returns.

The Church Commissioners’ investments will become part of a pool of “faith-aligned” impact investment capital that researchers at the Oxford Faith-Aligned Impact Finance (Oxfaif) project have estimated as being worth a total of $5tn worldwide. The majority of that capital — $3tn — is held by sovereign-backed Islamic finance funds, according to a report by the project in September 2022. Another $1tn represents private funds devoted to Islamic capital, while a further $300bn is “Dharmic” capital — from Hinduism, Sikhism and other Dharmic faiths. Christian faith-based impact investors control $260bn, while their Jewish counterparts hold $16bn.

While plans for the Church of England restitution project are still under development, the funds are intended to benefit projects in communities particularly affected by the legacy of enslavement. Tom Joy, the Church Commissioners’ chief investment officer, says the organisation hopes that a few, relatively small, investments in so-called “impact first” funds will encourage others with deeper pockets to join in. “When I’m talking about the impact-first investments we’ve made already, what we’re really focusing on with that is how we can be catalytic, providing the sort of vital seed capital to impact-focused managers . . . and attract further investment,” Joy says.

However, like many other faith-based investors, the Church Commissioners hold multiple types of investment in their endowment, which is worth £10.1bn. They range from the largest slice, made on a normal commercial basis, to some small investments which the commissioners regard as grants, rather than moneymaking propositions. For Muslim investors seeking a faith-based approach, Sophia Shepodd Innocenti runs the Global Islamic Impact Investing Forum, an umbrella group and discussion platform. She set it up after realizing that Islamic capital could have a far more positive impact if fund managers simply paid more attention to their investments’ effects. Islamic capital represents a large proportion of faith-aligned capital because Islam forbids the charging of interest, which is regarded as “haram”, or contrary to Islam’s sharia law.

Observant Islamic investors also steer clear of other haram areas, such as gambling, alcohol production and the arms trade. According to Innocenti, it ought to be possible to match Muslim investors, who avoid many harmful investments, to investments that promote the UN’s Sustainable Development Goals. “I realised about four years ago that the majority of sharia-compliant investing would work towards the sustainable development goals if they were just audited and modelled the appropriate way,” she says.

Gayle Peterson, co-principal investigator for Oxfaif, acknowledges that impact investing sits on a “spectrum” of activities that overlap at the margins. These range from impact investing to investments aligned with environmental, social and governance (ESG) principles to standard, financially driven investments. She classes impact investing as having more “intentionality” than traditional schemes where decisions are based primarily on the expected financial return. “You’re making decisions specifically around social impact,” she stresses. The categorization of investments partly reflects investors’ shifting thinking about how to put their money to work — and also how not to.

Joy says his organization has probably the most comprehensive list of exclusions of any investor — the Church Commissioners avoid financing tobacco, alcohol and gambling, among other areas. But they are focusing more and more on actively seeking to do good, rather than simply avoiding harm. “We increasingly believe, as a faith-based investor, that you should look at impact and look to effect change with any investments,” Joy says. “So you think about the positive — not just about avoiding things but about trying to effect change in the real world as well.”

There are similar issues in Islamic finance, according to Innocenti. “The easiest way for fund managers is just to become exclusionary in order to become Islamic-compliant — instead of looking at fundamentally ‘What do we want to invest in? What do we want the impact of our investments to be?’” she explains. She calculates that, if all Islamic funds started measuring the impact of their investments and using those measures to direct their decisions, it could free up enough money to achieve the UN SDGs by the target date of 2030.

Sophia Shepodd Innocenti argues that most sharia-compliant investing can support the UN’s Sustainable Development Goals

Sophia Shepodd Innocenti argues that most sharia-compliant investing can support the UN’s Sustainable Development Goals

Instead, she says, many Islamic funds concentrate solely on property. “A few impact funds have failed because Muslim investors are just so used to investing in real estate, essentially, that everything else seems daunting,” she observes. But Peterson points to programs backed by churches in Canada — including the Church of England’s sister church, the Anglican Church of Canada — as evidence that some impact investors are more imaginative. Just as the Church Commissioners are offering restitution for slavery, some Canadian churches are making impact investments to help those harmed in church boarding schools.

Peterson accepts that some faith-based investors avoid groups that wider society might regard as deserving. Some institutions, convinced that gay sex is wrong, will hesitate to devote money to projects supporting marginalised gay people, for example. For some Roman Catholic institutions, any involvement in healthcare has to steer clear of abortion. Nevertheless, Peterson argues that the aims of most faith-based investors fit neatly with the SDGs, which means the growing amount of capital at their disposal can help to narrow the wealth and wellbeing gap between people in poorer parts of the world and the industrialised countries. “I think it’s an opportunity to reach, with compassion and courage, resources that haven’t been tapped — and be more intentional about that,” Peterson says.

This article was first published in the Financial Times of February 20, 2023

TRENDING10 months ago

TRENDING10 months ago

PROFILE8 months ago

PROFILE8 months ago

BUSINESS & ECONOMY3 years ago

BUSINESS & ECONOMY3 years ago

BUSINESS & ECONOMY3 years ago

BUSINESS & ECONOMY3 years ago

BUSINESS & ECONOMY3 years ago

BUSINESS & ECONOMY3 years ago

HALAL ECONOMY9 months ago

HALAL ECONOMY9 months ago

BUSINESS & ECONOMY3 years ago

BUSINESS & ECONOMY3 years ago

BUSINESS & ECONOMY2 years ago

BUSINESS & ECONOMY2 years ago

Sophia Shepodd Innocenti argues that most sharia-compliant investing can support the UN’s Sustainable Development Goals

Sophia Shepodd Innocenti argues that most sharia-compliant investing can support the UN’s Sustainable Development Goals